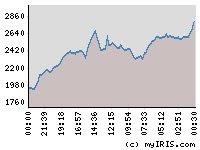

S ource : Myiris B ulls eye`, Sensex will touch 15,850 and the next target is 16,150, said Vishwas Agarwal, Technical Analyst, yesterday, just before the US Fed meeting and we have seen what has happened today (a day to remember). Heavy buying interest in heavyweights, strong global cues and cut in Fed rates led the Sensex touch a new high of 16,335.30. India`s benchmark index, Sensex, breached the magical figure of 16,000 mark in the morning trades. The Sensex marched ahead like an unbridled horse in the intraday trades and scaled new highs during the day. Finally, the index ended the day on a sunny note. The journey from 15,000 to the 16,000 mark was completed in 53 days. Commenting on today`s movement Vishwas said, ``I am bullish on Indian market up to September 30, with small possible correction,`` adding ``If the market trades above 16,350 level then the next ending point will be 16,666.`` Clearly on the day for which whole world was waiting, European markets opened with a ba